OVERVIEW

Finally, a Transformational Solution

Legal order teams face constant pressure from high volumes, tight deadlines, and strict compliance requirements. Delays and manual errors can lead to missed deadlines, incorrect seizures, and regulatory risk. Safari solves this with end-to-end automation—from electronic intake and subject matching to account lookup and secure response delivery. Built to comply with X9.129 and other standards, Safari reduces manual effort, increases accuracy, and ensures every step is visible and audit-ready.

AUTOMATED INTAKE

Streamline Intake with ServePort®

A core component of Levy Manager, ServePort is Safari’s infrastructure and network of connected agencies, law firms, and registered agents that automates the intake of all types of attachment orders. Instead of relying on faxes, emails, and manual routing from branches, ServePort creates matters automatically, eliminating data entry, preventing duplicates, and ensuring no documents are lost. ServePort also extracts key data—making no-touch processing possible for as many as 60% of levies. Building your own intake infrastructure means wasted IT time and resources when Safari’s ready-to-use connections are already in place.

DATA CAPTURE

Standards Leadership + AI

Safari’s leadership within the X9 organization keeps us at the forefront of legal order technology for financial institutions. As the only platform built to process structured formats like X9.129—and the upcoming X9.144 for subpoenas—Safari leads the industry in electronic legal order standards. For agencies still using PDFs or unstructured formats, our AI extracts key data and transforms it into structured, automation-ready input—enabling no-touch or 1-click processing without compromising accuracy or compliance.

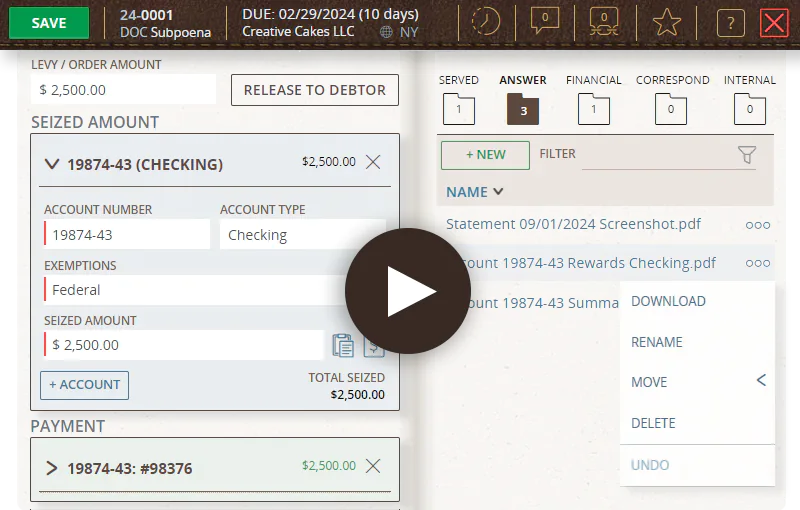

WORKFLOW AUTOMATION

No-Touch Levies™ Automate Every Step

Using integrations to your systems, Safari automates every step of the legal order process. It begins by checking whether the debtor is a customer, then retrieves account balances and transaction history to determine which funds, if any, can be seized. If there’s no customer match, no accounts, or no available funds, Safari automatically generates a response or uses a pre-built template. With built-in tools to automate freezes, holds, and releases, Safari enables faster, more accurate compliance—with complete visibility throughout.

WORKFLOW KNOW-HOW

Optimized for Every Attachment Type

With deep experience across levy types, Safari supports complex workflows like Continuous vs. Point-in-Time levies and 1-step vs. 2-step attachments. Our platform ensures that even the most detailed processes are automated and compliant. We also collaborate with agencies and customers to refine data matching upstream—ensuring clean intake, fewer errors, and smoother automation. This level of workflow optimization isn’t an add-on—it’s what sets Safari apart.

CENTRALIZED SOLUTION

The Visibility Management Needs, Built In

With Safari, every legal order—regardless of source, type, or processing path—is tracked in one centralized system. That means no more spreadsheets, scattered emails, or one-off processes hidden in individual inboxes. Managers gain complete visibility into volumes, response statuses, and compliance risks across the entire organization. Whether you're tracking turnaround time, policy adherence, or audit history, Safari brings the clarity and control legal and operations leaders need to make confident decisions.

TRUSTED SOLUTION

Customer-Driven Innovation

Safari is shaped by the people who use it. Our customers—some of the most experienced legal operations teams in the industry—continually influence the features and workflows we build. Rather than relying on rigid low-code platforms, Safari evolves in sync with industry standards like X9.129 and X9.144, so our customers never fall behind. It’s that customer-first model that drives real innovation—and why we maintain a 99% customer retention rate.

COMPLIANCE

Precision Compliance for Legal Orders

Compliance demands more than good intentions—it requires systems that enforce your policies. Safari equips financial institutions with built-in warnings and data fields that ensure exemption tracking, jurisdiction review, and state law compliance are never missed. From Restriction State logic to multi-state exemption warnings, our platform transforms policy into workflow—helping teams stay aligned with both internal standards and external scrutiny, including CFPB guidance.

ROI

Reducing Risk While Saving Time

Safari is built for operational efficiency at scale. With ServePort, teams eliminate manual intake by digitizing all served legal documents in one streamlined platform. Our AI transforms non-X9 levies into automation-ready formats, while integrated subject and account lookups allow up to 60% of orders to be processed automatically. For more complex cases, Safari’s 1-Click response feature simplifies fund seizures and releases—saving time, reducing risk, and delivering consistent compliance across your organization.

“Culturally, we strive for the best technology and people. We want to get away from manual processes because they take time and cost more in the long run. We're relying on Safari to replace outdated processes.”

Brian Hunt

Brian HuntSenior VP and GC,

First Merchants Bank

“The buzzword of our generation is automation. If I can find a way to do the job easier, I'm going to do it. That's what Safari delivers to our Levy processing team.”

Robert Hein

Robert HeinMember Solutions Manager,

Fox Communities Credit Union